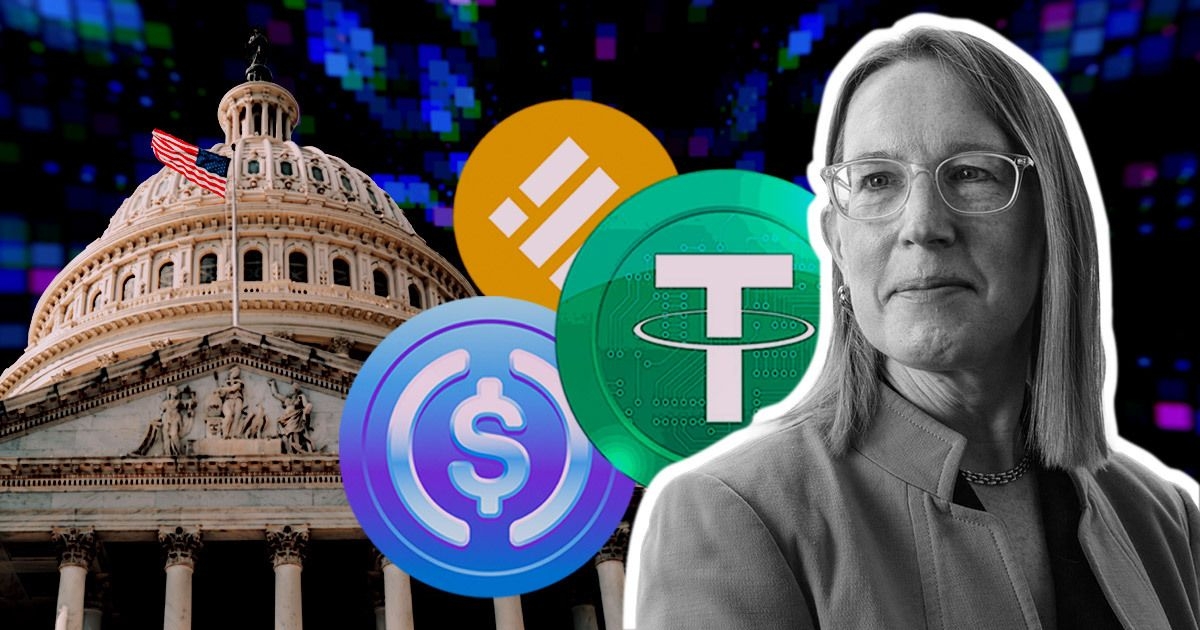

The United States Securities and Exchange Commission’s (SEC) Commissioner Hester Peirce urged the financial regulator to defer to the US Congress in its stablecoin regulation drive.In a Feb. 22 tweet, Pierce pointed out that Congress was “actively considering the issue,” adding that the SEC and other financial regulators could hold public roundtables pending results from the legislators.Stablecoins have generated increased scrutiny from regulators worldwide following Terra’s UST collapse in 2022. The regulators have pointed out how this asset class could impact the broader financial economy.SEC targeting stablecoinsThe financial regulator had issued a wells notice to stablecoin issuer Paxos on Feb.

13 that its Binance USD (BUSD) stablecoin was an unregistered security.Another stablecoin issuer, Circle, denied rumors that the financial regulator had issued it a wells notice about its USD Coin (USDC) stablecoin.Besides that, the SEC labeled Terra’s algorithmic stablecoin UST security in its lawsuit against Terraform Labs and its founder, Do Kwon.Wall Street Journal reported on Feb. 22 that the financial regulator was investigating whether stablecoins are products issued in violation of investor-protection laws.

Crypto lawyers reactDelphi Labs’ general counsel Gabriel Shapiro said the SEC could argue that stablecoins are securities because the:“Integration, promotion, marketing, commercial deals etc building the stablecoin ecosystems are “efforts of others” that are “reasonably expected” and can lead to profits in connection with the stables.”He added:“Stable[coins] might even pass the Howey test (nvm other types of securities tests like Reves), despite them being ‘stable’.”Another lawyer Mike Selig said the SEC’s characterization of Terra’s algorithmic stablecoin UST as security shows that “nearly anything can be a security.”Meanwhile, crypto exchange Coinbase emphatically stated that “stablecoins are not securities.”Over the past year, US SEC has increased its regulatory scrutiny of the crypto industry following the capitulation of several crypto firms and fraud perpetrated in the space.

Source : [SEC Commissioner Hester Pierce wants regulator to defer stablecoin regulation to Congress](news.google.com/rss/articles/CBMicmh0dHBzOi8vY3J5cHRvc2xhdGUuY29tL3NlYy1jb21taXNzaW9uZXItaGVzdGVyLXBpZXJjZS13YW50cy1yZWd1bGF0b3ItdG8tZGVmZXItc3RhYmxlY29pbi1yZWd1bGF0aW9uLXRvLWNvbmdyZXNzL9IBeGh0dHBzOi8vY3J5cHRvc2xhdGUuY29tL3NlYy1jb21taXNzaW9uZXItaGVzdGVyLXBpZXJjZS13YW50cy1yZWd1bGF0b3ItdG8tZGVmZXItc3RhYmxlY29pbi1yZWd1bGF0aW9uLXRvLWNvbmdyZXNzLz9hbXA9MQ?oc=5) undefined - CryptoSl