Those two worlds, in other words, have decoupled. This quarter, the correlation between bitcoin (BTC) and the S&P 500 declined from 0.91 to 0.59, and got as low as 0.01 on March 22. (A correlation of 1 means the price of two things is moving in lockstep, while minus 1 means a perfectly inverse relationship. Zero means no link at all.) In other words, digital assets have behaved as the diversifying, uncorrelated asset that many investors crave.

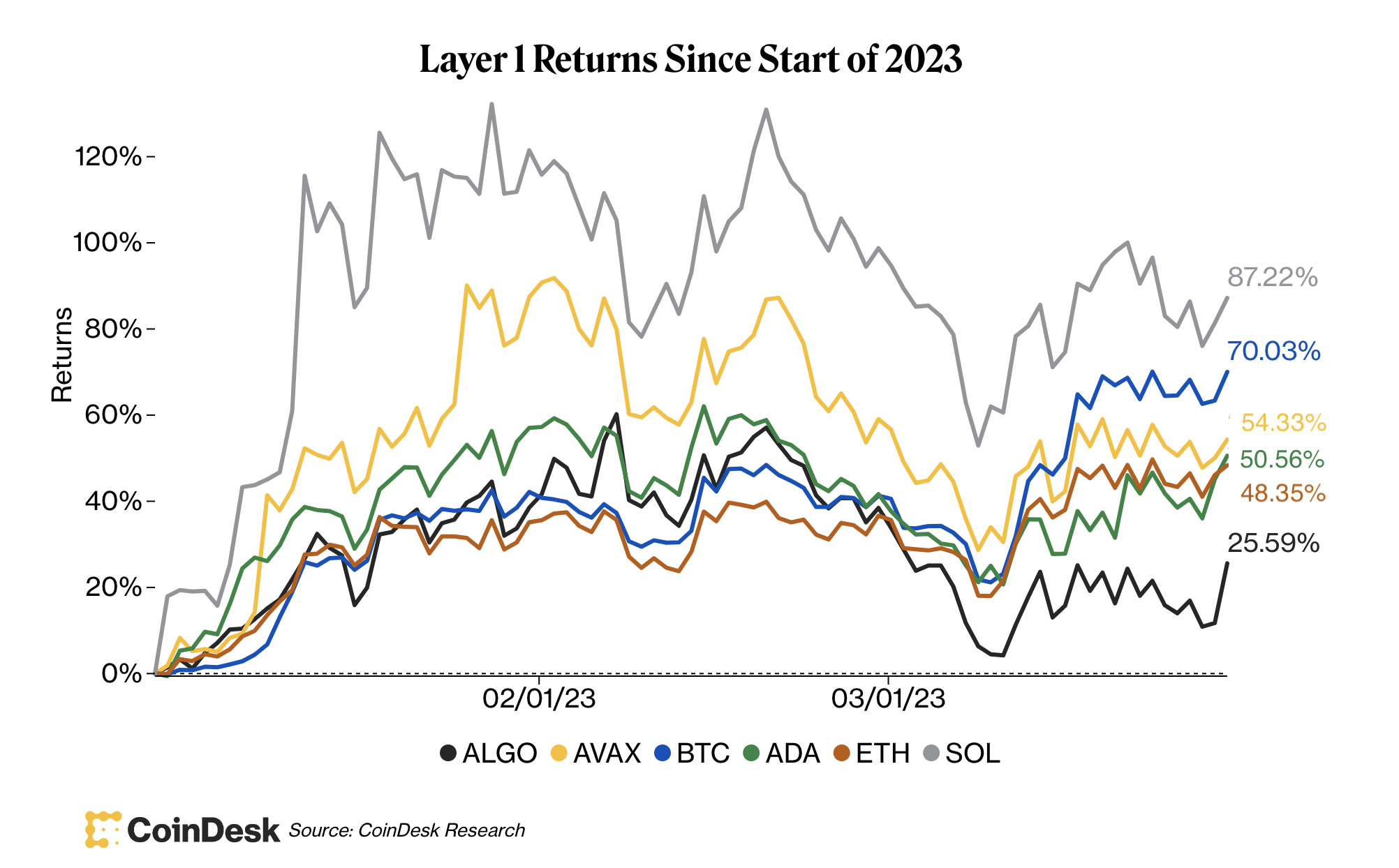

It’s been an eventful start to 2023, with what feels like a full year of news crammed into just three months. Year-to-date cryptocurrency returns, similarly, have been much bigger than is typical for a single quarter:

Layer 1s

Bitcoin: 71%

Ether: 51%

Avalanche: 58%

Cardano: 57%

Solana: 112%

Algorand: 34%

Traditional finance (TradFi) stock indexes

S&P 500: 3.2%

Nasdaq Composite: 11%

Dow Jones Industrial Average: -2.1%

Crypto stocks

Coinbase (COIN): 71%

MicroStrategy (MSTR): 64%

Marathon Digital (MARA): 99%

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

The top-performing digital assets (among those with market capitalizations of $1 billion or more) were the tokens associated with Stacks (STX), Aptos (APT) and Immutable X (IMX), which increased 443%, 268% and 213%, respectively. Among decentralized finance (DeFi) tokens with $100 million+ market caps, the top performers were Liquity’s LQTY, Trader Joe’s JOE and Injective Protocol’s INJ – which all surged at least 230%.

Bottom line: Digital assets have roundly beaten TradFi assets this quarter.

Those two worlds, in other words, have decoupled. This quarter, the correlation between bitcoin (BTC) and the S&P 500 declined from 0.91 to 0.59, and got as low as 0.01 on March 22. (A correlation of 1 means the price of two things is moving in lockstep, while minus 1 means a perfectly inverse relationship. Zero means no link at all.) In other words, digital assets have behaved as the diversifying, uncorrelated asset that many investors crave.

What is amazing about that, though, is these gigantic returns have coincided with a dramatic worsening of perceptions about cryptocurrencies as the U.S. government cracks down on the industry. Instead of being viewed as another asset class that fits within an overall portfolio, crypto is often viewed as a problematic asset linked to fraud and market manipulation.

If you want some insight into the prevailing government/regulatory view of crypto assets, I would invite you to read Chapter 8 of the most recent “Economic Report of the President.” On one hand, the dedication of an entire 36-page chapter to cryptocurrencies highlights digital assets’ rapid ascent. On the other, the tone of the report shows the regulatory hurdles that may be ahead.

While acknowledging the innovation of blockchain technology, the report largely labeled cryptocurrencies as holding no fundamental value, offering no alternative to fiat currencies and existing for the purpose of speculation only. I would offer that this is an extremely U.S.-centric point of view for a global asset.

Residents of countries with sky-high inflation and less-credible central banks arguably place significant value on obtaining an asset with a fixed supply. And an asset with global value likely has value within the U.S. as well.

The main macroeconomic issue for investors (in crypto or otherwise) remains inflation, and that is likely to continue for the immediate future. M2 money supply (a preferred inflation gauge of mine) is down 1.7% from a year ago. It’s good to see it falling, but it remains 38% higher than pre-coronavirus pandemic levels. The Federal Open Market Committee has responded by raising interest rates at the most rapid rate in history in an attempt to quell the increase in prices.

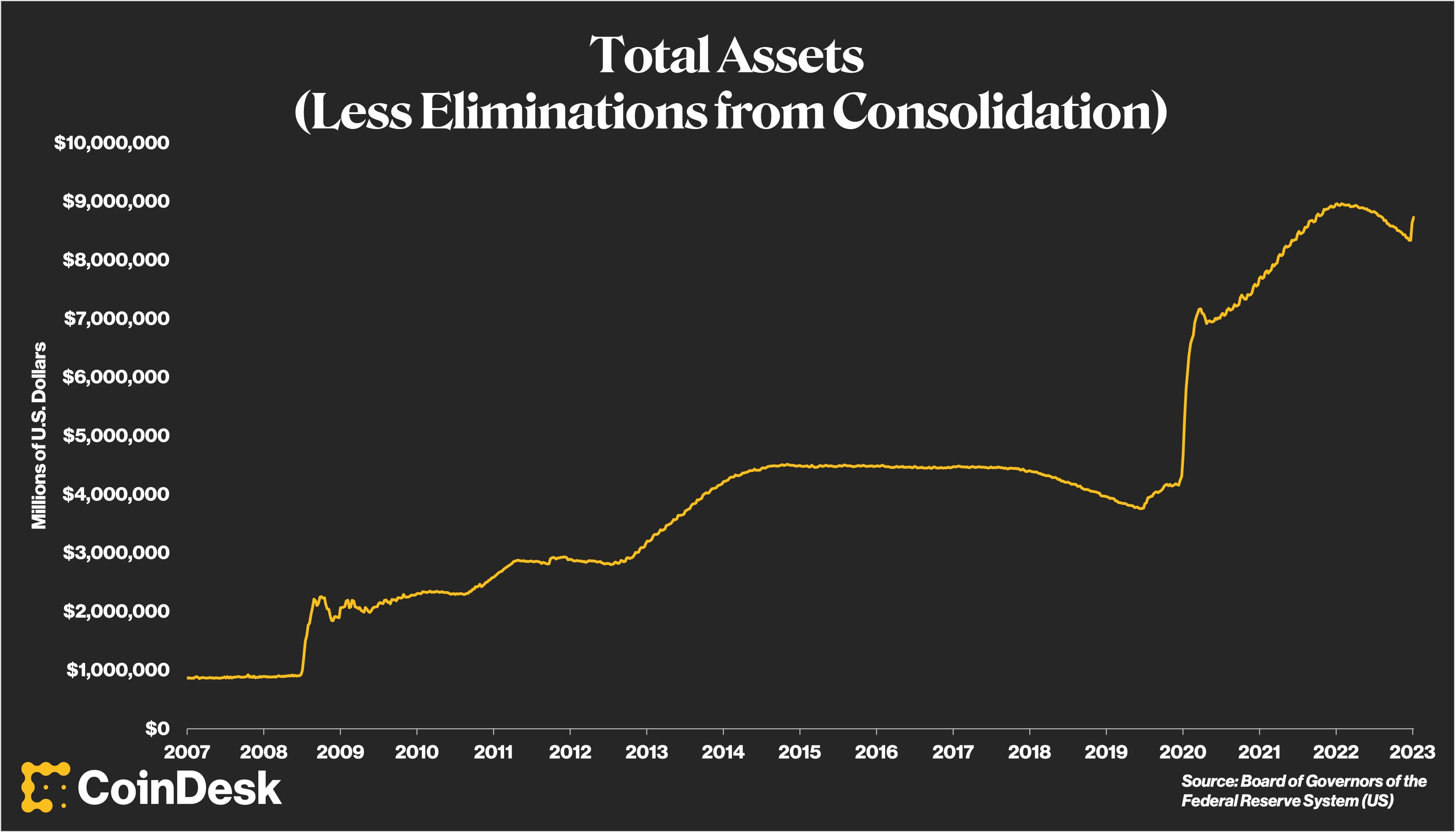

A recent issue that caught my eye was the federal government balance sheet has actually increased by 2.6% this quarter – including a 5% rise over the last week – as the U.S. helps rescue banks. This runs in stark contrast to the Federal Reserve’s previously announced effort to shrink the size of the balance sheet. Fed Chair Jerome Powell indicated the recent increase is temporary lending to banks and not intended to alter the stance of monetary policy.

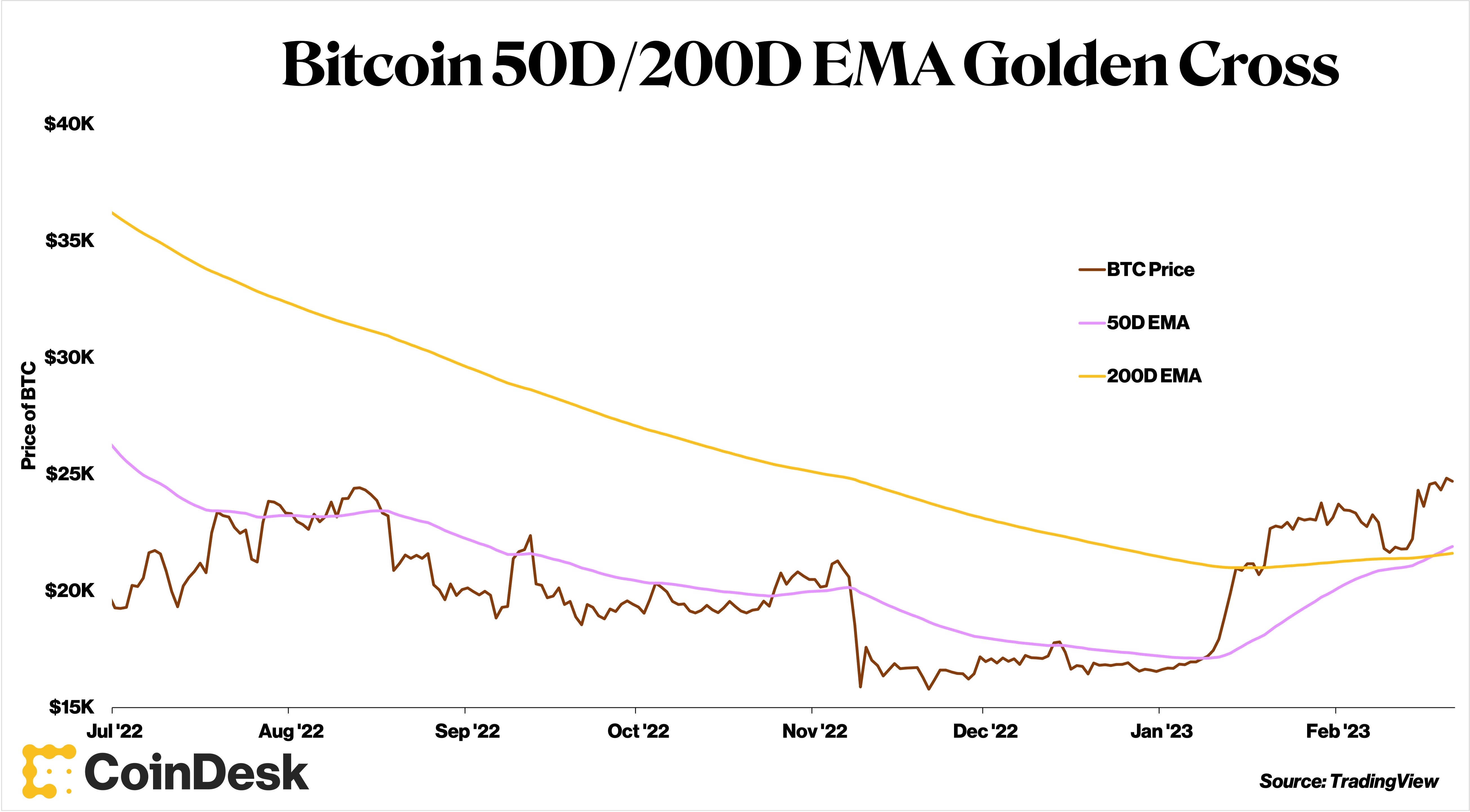

This past quarter also saw BTC hit a few notable technical signals. It warrants taking a look at how they ultimately panned out.

“Golden Cross” (Feb. 18): The fabled “golden cross” occurs when the 50-period moving average of an asset crosses above its 200-day moving average, and is often interpreted as bullish. We’ve seen this occur seven times since 2015, with its most recent occurrence on Feb 18. Entering a long position on the cross has paid off for investors who have done so, as prices are up 17% since this most-recent occurrence.

10/100 moving average crossover (Jan. 14): Similar in every aspect to the “golden cross” but with lower time frames, the 10/100 cross is one I look at for two reasons. The first being that there are 16 occurrences since 2015 versus seven for the golden cross. The second being that if the signal is viable, it should help identify bullish moves faster. Historically, the results have been unexciting, with just a 3% average return after 30 days. Those numbers will improve after the Jan. 14 occurrence, though, as BTC is 36% higher since that date.

RSI below 30 (March 10): Another popular signal is when the relative strength index (RSI) of an asset falls below 30, indicating that it is “oversold.” This has occurred 108 times for BTC since 2015, with two of the occurrences taking place on March 9 and March 10. The subsequent average 30-day return over all instances has been a 7% increase. Bitcoin is up 40% since March 10.

All in all, it's been a good quarter for digital assets – in terms of performance, anyway. Those who bought and held in January are richer. It will be interesting to see what this next quarter brings, and if the underperformance in perception takes a turn for the better.

Takeaways

From CoinDesk’s Nick Baker, here’s some recent news worth reading:

NOW BINANCE: One by one, major crypto figures have run into trouble in the past few months. Now, it’s the biggest exchange’s turn. Binance got sued by the U.S. Commodity Futures Trading Commission for allegedly letting Americans trade on its offshore exchange – which people in the U.S. aren’t supposed to be able to do. The CFTC specifically called out how Binance abetted trading by U.S.-based trading firms. These are the kinds of computer-driven liquidity providers that any exchange – in crypto, stocks, derivatives, whatever – needs to thrive. The trading firms (which weren’t identified by name) had set up offshore entities, but the CFTC alleges those were empty shells and the trading was intrinsically American. A higher barrier to liquidity providers is a serious threat to crypto.

AMAZON NFTS: Cognitive dissonance is rampant in crypto. As Glenn Williams discussed above, crypto returns were huge this quarter even as crypto regulation ramped up. Here’s more: Even as the industry faces a scary future, Amazon appears to be continuing its march toward offering non-fungible tokens (NFT). A hint along those lines came in the form of a receipt emailed to one of CoinDesk’s journalists.

FRESH START: Before FTX collapsed, the collapse of Three Arrows Capital (3AC) was in the running to be named biggest crypto blowup of 2022. Investors lost billions of dollars. Industry distress followed. The founders of 3AC are trying to make a comeback by capitalizing on the distress. Kyle Davies, in an interview with CoinDesk, discussed their plans for a new exchange where bankruptcy claims can be used as collateral. “If you think about why people are angry, it has nothing to do with me actually,” Davies said. “People are angry because the market went down. In terms of us, we have no regulatory action [against us] anywhere, no lawsuits at all. There's just nothing.”

YIELD CURVE: Although bitcoin has generated big returns in 2023, the inverted U.S. Treasury yield curve is getting closer to un-inverting (aka long-term yields are approaching their more normal position of being higher than short-term yields). This CoinDesk analysis talks about how that is reason for caution for investors.

Recommended for you:

Source : [Cryptos Gained in Q1 Despite Weakened Asset Class Perceptions](news.google.com/rss/articles/CBMiamh0dHBzOi8vd3d3LmNvaW5kZXNrLmNvbS9tYXJrZXRzLzIwMjMvMDMvMjkvY3J5cHRvcy1nYWluZWQtaW4tcTEtZGVzcGl0ZS13ZWFrZW5lZC1hc3NldC1jbGFzcy1wZXJjZXB0aW9ucy_SAXlodHRwczovL3d3dy5jb2luZGVzay5jb20vbWFya2V0cy8yMDIzLzAzLzI5L2NyeXB0b3MtZ2FpbmVkLWluLXExLWRlc3BpdGUtd2Vha2VuZWQtYXNzZXQtY2xhc3MtcGVyY2VwdGlvbnMvP291dHB1dFR5cGU9YW1w?oc=5) undefined - 100+CoinDesk / March 30, 2023