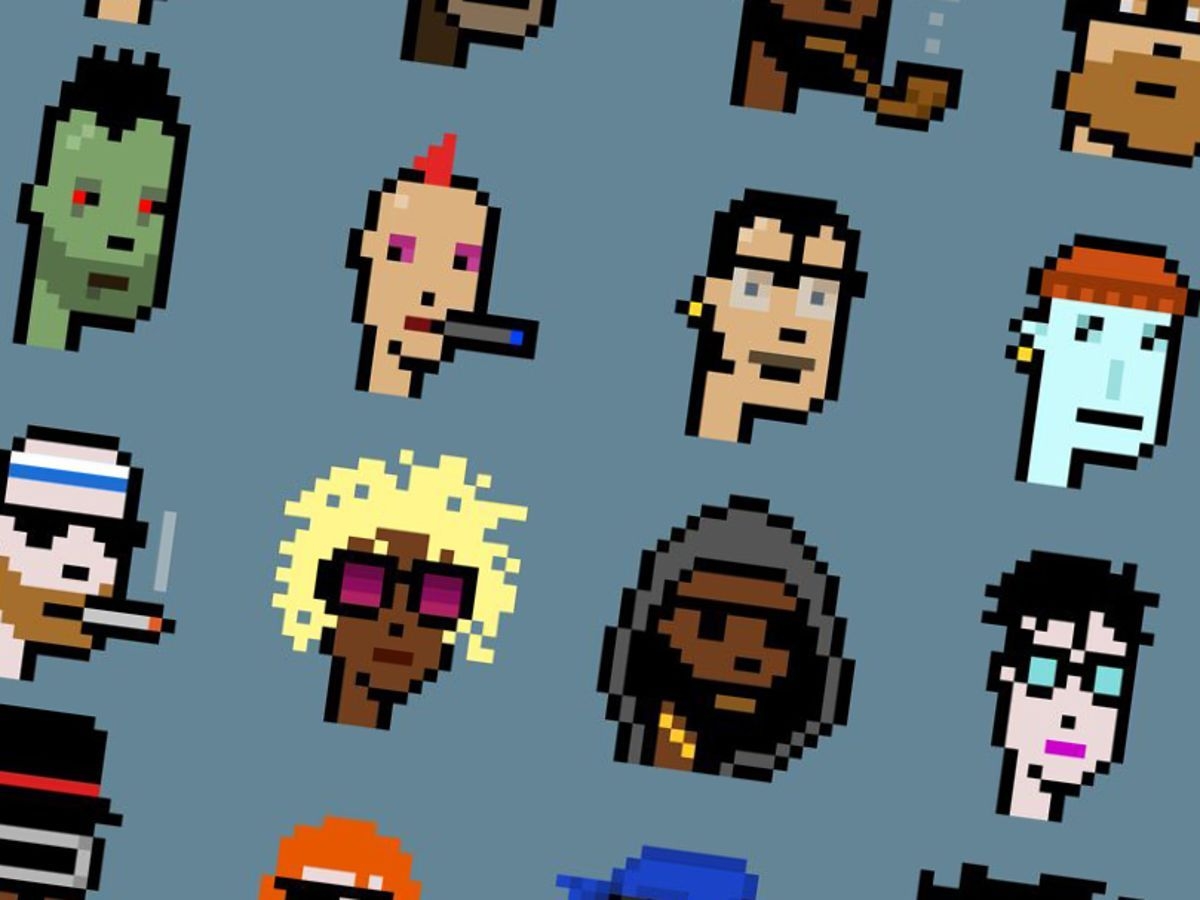

A year ago, Daniel Maegaard, one of the higher-profile collectors of nonfungible tokens, was spending tens of thousands of dollars on CryptoPunks featuring funky-looking people or apes. In the last few months, he’s been buying

NFTs

that typically sell for less than $2,000.

The shift is indicative of the metamorphosis taking place in the market for the once-coveted digital images promoted by the likes of Justin Bieber and Madonna. NFT sales plunged 67% sequentially in the third quarter as speculators and celebrities made an exodus, leaving the sector mostly to the dedicated long-term believers in the various potential use cases, and collectors betting that the plunge in prices will rekindle speculative demand.

“There’s more upside potential compared to other NFT projects with much higher market capitalizations,” said the 32-year-old Maegaard, who began investing in NFTs connected to land sales in the blockchain-based game Axie Infinity in early 2019.

Cheaper NFT collections and $100 gaming NFTs have been generally selling better than the expensive stuff, though Maegaard said he did sell a CryptoPunk depicting an ape in a hoodie for $4.45 million on Sept. 28. On average, an Ethereum blockchain-based NFT fetched $120 on Oct. 3, compared with $1,631 in early February, according to market data researcher NonFungible. On the Ronin blockchain used by Axie Infinity, average prices were down to $16 as of Oct. 3, from $69 in February, the researcher found.

The steep decline in cryptocurrency prices overall this year is credited mostly for the decline. On top of that, there is mounting concern about whether NFTs are likely to be viewed as securities, in light of the US Securities and Exchange Commission’s investigation of Yuga Labs Inc., the creators of the popular Bored Ape Yacht Club tokens.

“It is definitely not a super interesting space for short-term trading these days,” said Gauthier Zuppinger, co-founder of NonFungible. “Which may be an explanation why the space is currently at a pretty low pace.”

That’s transforming the competitive landscape, especially for NFT trading platforms, as buyers search for bargains and many new collections debut outside of the Ethereum blockchain. OpenSea, the world’s biggest NFT marketplace, had a 38% market share in September, down from nearly 85% in March, according to tracker DappRadar. Rival platforms x2y2 and Magic Eden have boomed -- with Magic Eden more than doubling its sales in September. Magic Eden had a 13.4% market share in September, up from also less than 1% in March, according to DappRadar. Last month, x2y2 boosted its share to 31.3%, up from less than 1% in March.

Source : NFT Bargain-Hunting Is in as Crypto Bust Craters Prices